Does Auto Enrolment apply to my business?

Posted on 22nd March 2017 at 17:05

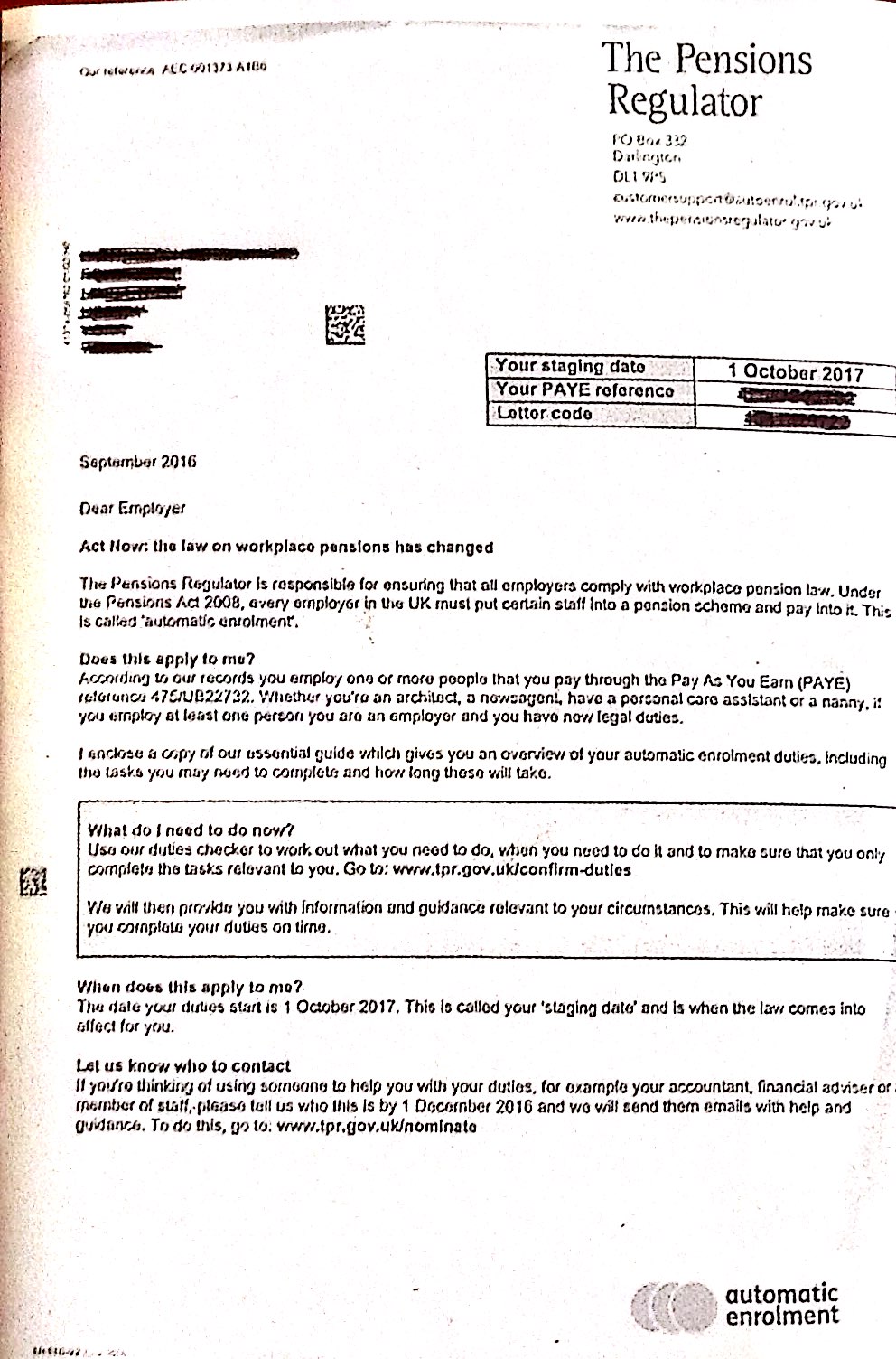

RECEIVED A LETTER FROM THE PENSIONS REGULATOR? THINK YOU MIGHT NOT BE AN EMPLOYER FOR AUTO ENROLMENT PURPOSES?

Automatic enrolment duties don’t apply when a company or individual are not considered an employer. You won’t have any duties if you meet one of the following criteria:

• you’re a sole director company, with no other staff

• your company has a number of directors, none of whom has an employment contract, with no other staff

• your company has a number of directors, only one of whom has an employment contract, with no other staff

• your company has ceased trading

• your company has gone into liquidation

• your company has been dissolved

• you no longer employ people in your home (cleaners, nannies, personal care assistants, etc)